The irony of life is that sometimes, the issues that matter most are also the least organized. Research finds that more than 40% of adults in the US, Canada, and Europe lack basic financial literacy. This means that they haven’t acquired the most fundamental financial skills to keep them out of debt and in control.

One advantage that current and future generations do have is a high level of digital proficiency. To turn things around and allow people of any background to successfully manage their finances, we need to use the right technology. Online money transfer solutions offer a great example, and here’s why.

Keeping everything in one place

Proper organization is the first and probably most important part of finance management. Knowing where your money is and following your budget closely will help you reach financial goals faster. That’s why it’s better to use a single app that allows you to keep track of everything in a tap. For work migrants specifically, a single app capable of managing the entire cross-border money transfer process is crucial.

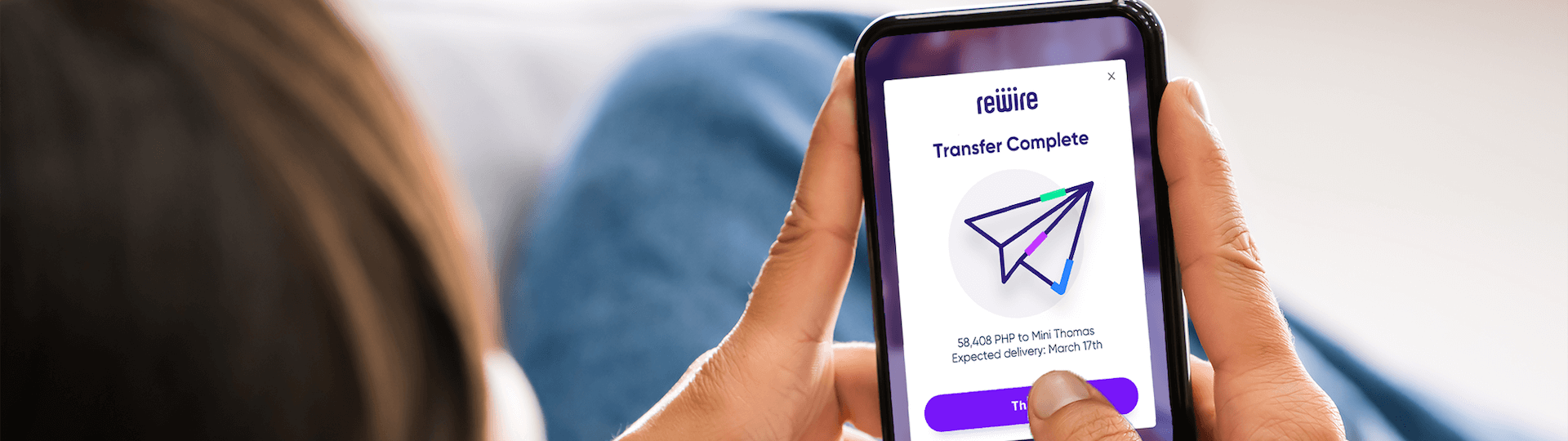

It’s best to choose a money transfer app that offers more than this particular service. Rewire’s app, for instance, includes local banking accounts, insurance payments, and more. This list continues to grow because we understand the value of bringing all of these services and accounts together under one efficient roof.

Solid collaborations

You want your money transfer solution to collaborate with local banks in both your country of origin and your current place of residence. This is part of the centralized approach we’ve discussed earlier and will help you track your finances without skipping a beat. Such collaborations also speak volumes regarding the money transfer solution’s authority and market position, which is a nice bonus, to say the least.

Gaining easy access

If you ever gave up on checking your financial status online simply because the website or app turned out to be too exhausting to handle, you’ll understand what I’m talking about. You’re also not alone, as nearly 80% of customers are unhappy with their bank’s digital performance. When it comes to your finances, user-experience (UX) isn’t a nice-to-have, it’s the most essential must-have. A user-friendly money transfer interface will allow you to easily track your progress and know which funds were transferred and when. The same goes for clear and conversational reports and customer support services.

The freedom to ask questions

Speaking of customer support, this is a critical component of money management procedures. Being able to ask questions and get clear and immediate answers is a big deal. You want your money transfer solution to offer detailed information regarding exchange rates, how long it would take for your funds to reach their destination, and more. That’s why we at Rewire make sure to write these articles and provide customers and readers with valuable tips and relevant information. The more you know, the more you save.

Does your money transfer solution help you manage your finances? If you want to learn more about what Rewire has to offer, contact us, and we’ll be happy to answer your every question.