How Can We Help You?

Rewire joined forces with Remitly, a remittance provider trusted by millions of people worldwide. Therefore, Rewire is not accepting new signups. Click here to join Remitly

You can add funds with various options:

- Instant Credit/Debit Card transfer

- Bank Transfer to a Rewire payment account (IBAN) that starts with the letters GB - you’ll be able to find it in your Rewire account, in the “Account” tab

- Transfer from your Bank (SEPA transfer)

Here is a full web guide to load funds to your Rewire account. Here is a video guide.

It is an individual client reference, so we can credit your money to your respective Rewire account.

The time taken to deposit money to your Rewire account depends on the mode of transfer as below:

- Credit/debit card - Immediately

- Instant bank transfer - Immediately

- Transferring from your Bank account to Rewire's account - 2-3 business days

For a full guide on depositing money to your account click here. For a video guide click here.

You can make sure your salary is deposited into your Rewire account via the payment account (IBAN) - you’ll be able to find it in your Rewire account, in the “Account” tab, or via credit card.

For more information on how to set up your IBAN account or check your IBAN details click here

click here for a video guide on transferring to your IBAN.

Rest assured that it will be credited to your account. Although crediting the funds in your account might take a while, the reference is a very important part of transferring money to your account. Every Rewire client has their own reference number. Please make sure to put the reference.

If this happens, kindly contact our Support immediately on WhatsApp: +49 1609 941 4871. We will try our best to locate and credit your funds ASAP within 1-2 business days.

Once you complete & receive your Rewire payment account (IBAN) you can add money into the Rewire IBAN according to limits of money that can be transferred based on the regulatory process.

Important note: be sure to transfer to the ‘loading from UK’ IBAN account.

In order to send money to mobile wallet, you need to select “SEND MONEY” Tab in the app

- Enter the amount

- Add beneficiary details (Bank details), and confirm whether all details mentioned & amount is correct.

- Choose “Receiving Method” as “Mobile Wallet”

- Choose the type of mobile wallet between Gcash and Coins.ph, then enter the account number and click "Add."

- Then choose payment method - Instant bank transfer, Instant credit/debit card transfer or send money to your Rewire account.

Once you have appropriate balance, your order will be processed the same day

For a guide click here

If you need to change your beneficiary's details please contact our support team as soon as possible.

Email: [email protected]

Phone: +49-800-000-0475 (toll free)

WhatsApp: +49-1609-941-4871

You can reach us via phone, email, WhatsApp, or Facebook messenger

Check the contact details and the opening hours at the bottom of the page.

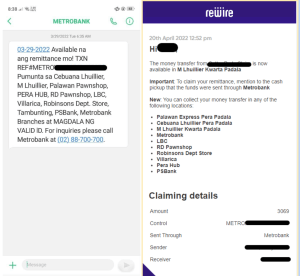

You can send to a choice of cash pick-up outlets. When sending money home through your Rewire app, you can choose Metrobank for cash pickup.

Your beneficiary will then be able to collect the money from any Metrobank cash pickup point in the Philippines including M Lhuillier, Cebuana, Palawan Express, Metrobank, LBC and many more see a full list here.

- To place an order you need to select the “SEND MONEY” tab,

- Enter the amount, and choose the 'Cash Pick-Up" receiving option.

- Add beneficiary details and choose which Cash-pick-up, we recommend selecting "Metrobank" (which includes all the pick-up businesses) and then the address of the location.

- Lastly, confirm whether all details mentioned & the amount are correct.

You can deposit money on various options: *Instant Bank transfer *Instant Credit/Debit Card transfer *Bank transfer

Once you have the appropriate balance, your order will be processed the same day. Once the money reaches your beneficiary, we will send you a confirmation and the relevant claiming information by SMS and it will also be shown on your Rewire Home and History tab. The message your beneficiary will receive might contain the word “METRO” instead of “REWIRE.” That’s 100% OK.

For a full guide click here

New at Rewire - the same cash pickup method, more locations in the Philippines to send your money to.

All thanks to Rewire’s newest partnership with Metrobank.

When sending money home through your Rewire app, you can choose Metrobank for cash pickup. Your beneficiary will then be able to collect the money from any Metrobank cash pickup point in the Philippines. Here is the list of locations your beneficiaries can pick up the money you send:

- Palawan Express Pera Padala

- Cebuana Lhuillier Pera Padala

- M Lhuillier Kwarta Padala

- Metrobank

- LBC

- RD Pawnshop

- Robinsons Dept Store

- Villarica

- Pera Hub

- PSBank

The message your beneficiary will receive might contain the word “METRO” instead of “REWIRE.” That’s 100% OK.The message should look like this:

- Make sure you have a registered/active Poste.it online banking account.

- Download the PostePay app and make sure to turn on push notifications of the PostePay app

- When you open a Rewire order, at the same time make sure to check the phone for notifications from Postepay

- Click on your phone notification which says “Pagamento E-COMMERCE” (Payment to E-Commerce).

- Once that pop-up notification is clicked, it will open the Postepay app on the page where they will click “Autorizza” (Authorize) then exit the Postepay app.

- Now when you go to load from your Postepay card a pop up will appear, click “Ho Autorizzato in App! Continua” (I have authorized in the app, continue).

For a step-by-step guide click here.

In able to place an order you need to select “SEND MONEY” Tab

- enter the amount

- add beneficiary details (Bank details), and confirm whether all details mentioned & amount is correct.

- once you have appropriate balance, your order will be processed the same day

For a video guide click here for a web guide click here

Currently, you can send money to the following countries:

The time to transfer money to your Rewire account depends on the mode of transfer as below:

- Transfer to a bank account - between 10 minutes up to 2 business days

- Transfer to a Cash Pick up - Immediately

- Transfer to Palawan Cash Pick-Up - Up to 1 business day

- Transfer to Gcash & Coins.ph - up to 1 business day

- Transfer to Paga Mobile Wallet - up to 1 business day

*Due to unforeseen circumstances, your transfer could be delayed by a few business days. These circumstances include transfers made on weekends, regulations of the country, public holidays, any change in ID requirements, compliance, time-zone differences, or any other government requirements.

Rewire was founded for immigrants.

During this time we created strong commitments with our partners worldwide enabling us to give you quick service with low fees.

Unified Payment Interface (UPI) is a popular payment method in India. It allows you to transfer money fast and securely to a bank account in India, with no need to type a long bank account number - all you need is to type a short Virtual Payment Address (VPA) and your order is ready to go.

We have a strong professional support team that works for you 7 days a week in your language, you can call us, write us via email, WhatsApp, ‘SMS’ etc.

We are providing the best international rates with lower fees and faster transfers.

Depending on the country you're sending to Rewire has a small fee for the transfer.

This fee is only charged when you send money home.

There are no hidden charges otherwise.

If you choose to add money via credit card or a bank transfer (via Token/Klarna), a fee might apply. You will always see this fee in your app before adding money.

Don't forget you have a discount on your first order. Sign up here

Virtual Payment Address (VPA) is your UPI ID. It is a short ID that you can easily generate by following 5 simple steps:

1) Download a UPI-enabled app

2) Provide your bank account details

3) Choose a VPA

4) Link VPA to bank account

5) Submit details after verification

You can make a local transfer from your Rewire account to any bank in Europe, it's fast and free.

For a full video guide click here.

Using the UPI transfer method is easier than transferring directly to a bank account.

- You don’t need to use a long bank account number, just type the VPA (Virtual Payment Address), which is short and simple to generate. This way there is less chance to make mistakes when sending money to your beneficiary.

- UPI transfers are immediate. 90% of these kinds of money transfers will be completed within minutes.

- More and more Indians can now accept UPI payments, and you can even pay your bills with it.

Your friends don’t have to have a Rewire account in order to get your money. The transfer is made straight to their bank account, you simply need to know their full name and IBAN number.

For a full video guide click here.

Click here to follow Rewire’s step-by-step guide of sending money through UPI.

It will be completed within 1-3 business days (depending on the receiver’s bank).

How can I send money to Nigeria?

Sending money to Nigeria is easy and can be done in one of two ways: bank transfer and cash pickup.

- Bank transfer: You can send USD to domiciliary accounts in GTBank, Fidelity UBA, and Access Bank in Nigeria (more banks to follow). Or, you can send money to any FCMB account, and a USD account will automatically be created.

- Cash pickup: You can send USD for cash pickup *arrives within 30-minutes* See all the available GTBank and Fidelity pickup points across Nigeria.

Note that NGN cannot be processed due to new CBN regulations.

I added money to my Rewire account. Can I get it back?

Yes. Contact customer support on WhatsApp at +49 1609 941 4871 so that they can credit your account.

Does the recipient’s account have to be in USD?

Domiciliary accounts: If you send money to a GTBank, Fidelity, UBA, or Access Bank accounts you must make sure that the recipient’s account is allowed to accept USD.

Automatic USD accounts: If you send money to an FCMB account, a USD account will automatically be created. The next time you send money to that account, the funds will automatically be directed to the receiver’s USD account.

What are the transfer limits?

You can send up to €2,500 in one transaction.

What are the fees?

€0.99 flat fee

How to open a Domiciliary Account?

To open a domiciliary account and receive USD international money transfers in Nigeria, you will need the following:

- Filled and signed a Domiciliary Account registration form

- A copy of an identification document (driver's license, international passport, national ID card, or any other official document that is acceptable by the bank).

- A passport photo

- Two (2) completed reference forms

- A utility bill, under the account holder’s name, issued within the last 3 months

For more information please visit the GTBank website or the Fidelity website.

How can I send cash to Nigeria?

If you want to send cash to Nigeria follow these steps:

- Click the “Send Money” tab

- Enter the amount of money you wish to send

- Add the receiver's details: first name, last name, city (of the receiver), phone number (of the receiver)

- Choose the receiving method: cash pickup

- The receiver needs to say that it's being sent through “THUNES” which is our partner provider and show the order number.

That’s it. The money should arrive within 30 minutes.

Here are all of the cash pickup spots that GTBank or Fidelity offer across Nigeria.

For a full guide on sending to cash pick-up click here.

How long will it take to process my transfer to Nigeria?

Cash pick-ups are mostly available within 30 minutes.

Bank transfers take up to 1 business day.

Will my recipient be notified when the cash is available for pick-up?

Once the cash is available for collection, your recipient will get an update via SMS.

What will my recipient need to provide in order to pick-up cash in Nigeria?

In order to receive the cash you sent, your receiver will need:

- A valid ID

- BVN (bank verification number)

- The reference number he or she received via SMS

To find the best cash pickup location for your receiver, see all of the cash pickup spots that GTBank or Fidelity offers across Nigeria.

You can locally send money to your friends and family who have a European bank account anywhere in Europe, it’s fast and free.

Rewire is an online financial services platform for migrants living in Europe, so we create services to support them while living in Europe including sending money home to their families and friends. We don't act as a regular international money transfer so for now it only operates from Europe to your home countries.

It can take between 10 mins to 2 Business days depending on the receiving country banks.

You need to sign in your Rewire account, open the "History" tab where you will find all the details of your Rewire transactions.

It depends on the mode of transfer you choose. They can receive it by bank transfer, cash pick-up (the Philippines and Nigeria only), or mobile wallet option (Philippines and China). You will get an email and SMS when the money has arrived at its destination. Additionally, it will appear in the order history tab, it will say "order complete."

For Mobile Wallet, the beneficiary will get an SMS/notification on their phone that the money has arrived.

For more information see our web guide here.

For assistance on how to choose the best way to transfer your money, you can contact our support team at Rewire.

You will receive Email & SMS once money has been credited to your beneficiary account.

SSS is a social insurance program for employees in and from the Philippines, available to workers in private sectors and Overseas Filipino Workers (OFWs) abroad. Services include protection, retirement and health benefits for all OFWs abroad who pay SSS contributions.

SSS guarantees benefits to Overseas Filipino Workers (OFWs) in case of sickness, disability, maternity leave, unemployment, retirement, and more. This helps you to secure your future and avoid financial surprises. You can find an overview of SSS benefits here.

Yes! You can pay your contributions online via your Rewire App - just a click away and comfortably from your own home. No queues, no opening and closing hours, no need to send money home first. Click here to learn how to pay SSS using Rewire. If you don’t have a Rewire account yet, you can sign up for free here.

Paying SSS in the Rewire app is very easy.

1. Get your SSS number ready. If you don’t have an SSS number yet or your number is outdated, please contact your SSS office.

2. Open the Rewire app. From the Home tab, click on the 3 dots in the top right corner to open the side menu. Click on ‘SSS’ and follow the instructions. If you don’t have a Rewire account, sign up here for a free account. For a guide on loading money to your Rewire account, click here.

3. Your payment to SSS will be processed within one hour. You’ll be notified once the payment is approved.

For more information, check out the step by step guide or the video guide to paying SSS.

It could be that the payment reference number (PRN) that belongs to your SSS membership is not updated. Kindly contact the EU Foreign SSS representatives via the contact details on this page to check for problems with your SSS number.

It usually takes up to 1 hour to process. You will be notified once the payment is approved.

It’s completely free of any charges.

Paying your SSS contributions with Rewire is completely safe and secure. We have partnered with Ventaja, the Philippine government’s largest collection partner overseas, to make sure your payments are processed quickly and safely.

Opening an account with Rewire will give you a free IBAN and also allow you to make free online and offline transactions with a Rewire MasterCard.

On the Account tab, click on Complete My Account

Next, you have to upload your ID for verification purposes. It can be a Passport, Driver's License or Identity Card.

1. Upload the document or take a photo of it.

2. Take a selfie

3. Fill in your address and personal information.

And you're done! Your IBAN will be ready for up to 2 business days.

For a web guide click here for a video guide click here.

You can find all the details about your purchases, credits & transfers on your History Tab in your Rewire account.

After all your documents are accepted, you will receive an IBAN, which will be sent to you through email & you can find it on the "My Account" tab when you are logged in to your Rewire account.

A source of funds can be one of the following:

- A Bank statement where your salary is deposited (Showing the past 3 months)

- Salary slip (from the past 3 months)

- Annual account/incorporation docs for any self-employed persons (no older than last year)

- Official letter/ proof of government allowances/ scholarships etc.

- Loan agreement

- Official docs showing sale of personal assets such as a car or house

- Filed tax return (no older than last year)

- Official letter of pension approval ( current year )

A Source of funds will not be accepted if it is:

- Not under your name

- A blurry or a cut document

- Outdated/Expired

- Incomplete document

- Invalid document type

A Proof of address can be one of the following:

- Utility bills: (e.g Electricity, Water, Mobile Bill, etc...) from the past 3 months

- Official governmental documents (e.g official municipality registration)

- Bank statement (from the past 3 months) - The bank statement should be from a traditional bank; bank statements from online banks are unacceptable as proof of address documents.

A Proof of Address will not be accepted if it is:

- Not under your name

- A blurry or a cut document

- Outdated/Expired

- Incomplete document

- Invalid document type

Once your friend has signed in & activates his account with a minimum transfer of €90, you will receive a Bonus of €10 into your Rewire balance and your friend will get 3 FREE TRANSFERS!

Read terms and conditions.

For a web guide click here, for a video guide click here

It's simple just click on the link and it will take you to our app, where you will see a pop up that you were gifted with 2 free transfers. Continue the registration process and the 2 free transfers will automatically be applied to your transfer. Your friend will benefit too.

Yes, we do have ambassadors & marketing partners program, to register yourself please send an email to [email protected]

To add your coupon code, you need to sign in to your Rewire account, press Send Money & you will find Add Coupon at the bottom of the page.

For a step-by-step guide of how to add a coupon code to your account click here

To invite your friends to Rewire, you need to log-in to your account and select the “Share Rewire” button where you will find options to share via Whatsapp, Email, Facebook.

Once your friend has signed in & activates his account with a minimum transfer of €90, you will receive a Bonus of €10 into your Rewire balance, and your friend will get 3 free transfers!

For a web guide click here, for a video guide click here

We use two-factor authentication on some higher-risk occasions to verify your identity. When you’re signing in from an unrecognized device, we’ll send you an SMS code to your phone to make sure it’s really you. Additionally, when adding a new beneficiary, any actions related to your debit card - like viewing card, viewing password and freezing card will require you to reenter your password. Ensure you provide your mobile number and keep it updated to add another layer of security to your profile. If you need to update your phone number you can contact support to do so.

In order to update your passport/ID you need to contact support to assist.

Email: [email protected]

Phone: +49-800-000-0475 (toll free)

WhatsApp: +49-1609-941-4871

You can reach us via phone, email, WhatsApp, or Facebook messenger

Our offices in Europe are located in the Netherlands.

To increase your limit you can contact our support team for special permission you will have to provide proof of salary in some cases.

Email: [email protected]

Phone: +49-800-000-0475 (toll free)

WhatsApp: +49-1609-941-4871

You can reach us via phone, email, WhatsApp, or Facebook messenger

Check the contact details and the opening hours at the bottom of the page.

Rewire works with institutions that have acquired all financial licenses necessary to operate in Europe and the United Kingdom. All our activities are recorded and monitored by financial institutions in the EU and the UK.

We have more than 600,000 customers around the world happily using our services, you can read their reviews here

We take measures to protect your identity so you can send money securely. You can help us keep your profile secure by doing the following:

- Select a strong password (with upper case, lower case letters and at least a number) and change it often.

- Don’t share your login details with anyone.

- Selecting Facial Recognition when available as an option to log in, is one of the safest options as only your face will be able to enter your account

- Ensure you provide your mobile number and keep it updated to add another layer of security to your profile. We use two-factor authentication on some higher-risk occasions to verify your identity. When you’re signing in from an unrecognized device, we’ll send you an SMS code to your phone to make sure it’s really you. If you need to update your phone number you can contact support to do so.

For more ways to keep your account secure read here.

Communication is key to understanding your account activity and it is vital to ensure healthy financial management. Through various communication methods including SMS, email, and app notifications, Rewire can let you know of movements in your account as well as special promotions and discounts.

Still, if you would like to unsubscribe from any of the communication methods mentioned above, you can easily do so in your account settings.

Simply log into your Rewire account and tap on “More” on the home screen menu. Tap “Profile settings” and then select the communication methods you would like to receive by turning it on or off.

The communication methods include SMS, email, and various push notifications.

Your selection will automatically be saved. And, don’t worry, you can always go back and resume communication as Rewire is always happy to interact with you.

You are more than welcome to contact us 7 days a week on Email at [email protected]

Also available on all digitals channel chats like Facebook messenger

Email: [email protected]

Phone: +49-800-000-0475 (toll free)

WhatsApp: +49-1609-941-4871

You can reach us via phone, email, WhatsApp

Because of (international) regulations and our internal risk policies, you are not allowed to use your Rewire account for transactions that:

- Are illegal under applicable law

- Are based on funds obtained by illegal activity, or intended to fund illegal activity

- Are intended to avoid taxes or other legal duties

- Are intended to avoid seizure of funds by law enforcement authorities

- Violate an order of any court of law

- Are connected to the sale and/or supply of drugs, adult material, gambling, cryptocurrency, foreign exchange, counterfeit products, or any other illegal activities such as pyramid and ponzi schemes.

Rewire has the right to suspend your account in case of suspicious or fraudulent behavior. The full list can be found in our general terms and conditions

In order to secure all your data privacy & personal information Rewire follows International rules & regulations, it is a necessity to obtain Identity for each user to utilize all the benefits of our services. As a client of our service, you will be required to verify your identity or personal information. The other reason we do this is so we can verify that only you are able to send your money. Among the types of information, we may request are your full name and date of birth, plus documents such as your passport, driver’s license, or national I.D. card.

In order to change your phone number, follow these steps:

- Open your Rewire app and log in to your account.

- Choose the "More" option in the menu.

- Once the "More" option is open, choose "Profile Settings".

- After your "Profile Settings" appear on the screen, you'll see your phone number and, next to it, the option "Change number".

- Click on the link to change number and then type your new number.

- Click on "Update," and this is it.

You've changed the phone number associated with your Rewire account.

It's no problem. Go to the app, then you need to click "forgot" under the password section in the login page. You will need to enter your phone number, a code will be sent via SMS. You will then need to insert that code and after that, you will be able to change your password.

For a video guide click here.

In order to close your account you can contact our support team.

Email: [email protected]

Phone: +49-800-000-0475 (toll free)

WhatsApp: +49-1609-941-4871

You can reach us via phone, email, WhatsApp, or Facebook messenger

Check the contact details and the opening hours at the bottom of the page.

We take measures to protect your identity so you can send money securely. You can help us keep your profile secure by doing the following:

- Select a strong password (with upper case, lower case letters and at least a number) and change it often.

- Don’t share your login details with anyone.

- Selecting Facial Recognition when available as an option to log in, is one of the safest options as only your face will be able to enter your account

- Reset your password if something doesn’t look right. If you receive an update about recent changes to your profile or activity that you aren't familiar with, changing your password right away is the best thing to do.

- Download the Rewire app from the App Store or Google Play Store. While our website is safe as well, the Rewire app offers better security than web browsers, as well as a more intuitive user experience and the ability to receive notifications about transfers and profile activity.

- Ensure you provide your mobile number and keep it updated to add another layer of security to your profile. We use two-factor authentication on some higher-risk occasions to verify your identity. When you’re signing in from an unrecognized device, we’ll send you an SMS code to your phone to make sure it’s really you. If you need to update your phone number you can contact support to do so.

- Remember to sign out of Rewire when you're done if you access the service from a device that isn't yours, such as a public computer or shared mobile device.

- Make sure your device is updated regularly. Make sure your computer has the latest software updates and that your mobile device has the latest versions of iOS and Android.